Washington D.C. – Few economic reports shake markets like the Consumer Price Index (CPI). The Bureau of Labor Statistics’ (BLS) monthly release can swing equities, bonds, and currencies within seconds. But for a select group of traders, the real action begins long before 8:30 a.m. ET.

Welcome to the world of CPI whisper numbers—the unofficial inflation forecasts whispered through trading desks, encrypted chats, and research notes. These whispers can tilt futures markets, spark pre-release volatility, and offer opportunities for traders who know how to read them.

The Genesis and Circulation of CPI Whispers

Unlike the polished consensus forecasts on Bloomberg or Reuters, whisper numbers are fluid, informal, and insider-driven. They move quickly, often changing as new intel surfaces. Sources include:

- Proprietary Research: Hedge funds and banks crunching alternative data, from credit card receipts to energy usage.

- Inter-Dealer Broker Chatter: Traders piecing together sentiment throughout the day.

- Expert Networks: Economists, former government officials, and academic contacts.

- Forums & Social Media: Niche corners of X (Twitter) and Discord where sentiment leaks out to retail traders.

Once a whisper takes hold, it spreads through client notes, private calls, and secure channels—often moving markets hours before the BLS makes anything official.

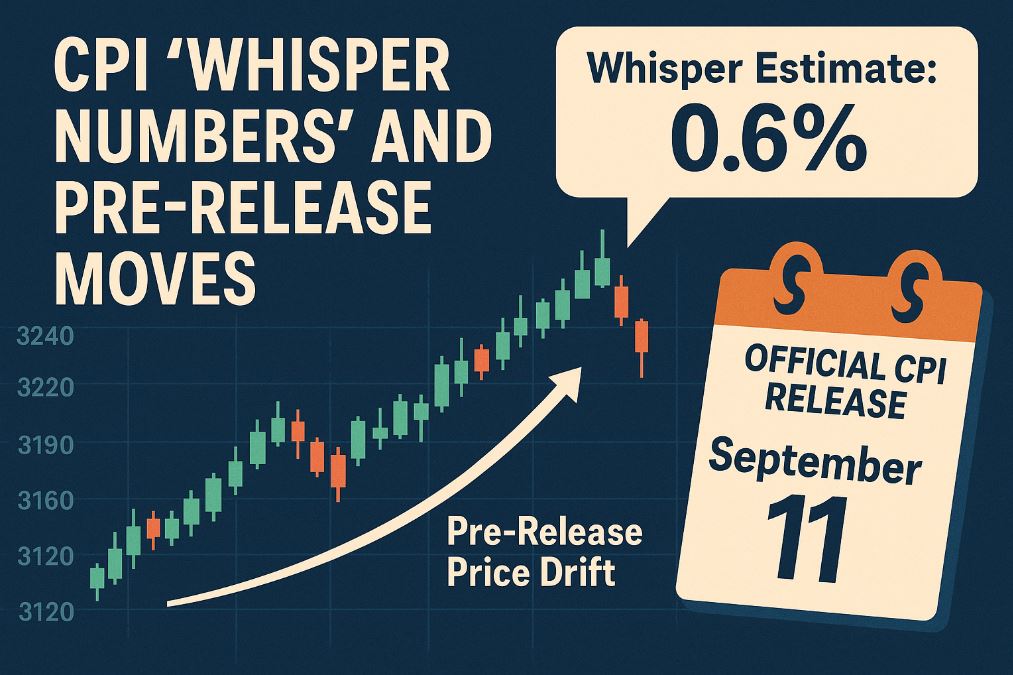

Pre-Release Futures Behavior: The Telltale Drift

The 24 hours leading up to CPI often show fingerprints of whisper activity:

- Price Drift: Markets quietly shift in the direction of the rumored surprise. A hotter-than-expected whisper? ES futures may sag before the number drops.

- Volatility Compression, then Expansion: IV often falls into the release, then snaps higher as positioning accelerates.

- Order Book Dynamics: Large passive orders hint at where institutions expect the move, while bursts of small market orders may confirm consensus around a particular whisper.

While powerful, these signals aren’t perfect. They reflect a marketplace of competing rumors—sometimes right, sometimes intentionally misleading.

Risk Management: Taming the Beast

Trading whispers is a high-risk, high-reward game. Without strict controls, it’s easy to get burned.

Key controls include:

- Position Sizing: Risk no more than 0.25%–0.5% of capital on a whisper-driven play.

- Invalidation Levels: Use hard stop-loss orders, not mental stops.

- Source Credibility: Weigh the difference between a reliable research desk and random forum chatter.

- Technical Alignment: Confirm with market structure before leaning on a whisper.

- Options Hedges: Puts and straddles can reduce downside if the rumor proves false.

- Post-Release Discipline: Expect violent whipsaws. Stick to pre-planned exits.

CPI Release Calendar – September to December 2025

Mark your calendars—CPI lands at 8:30 a.m. ET on these dates:

| Reference Month | Release Date |

|---|---|

| August 2025 | September 11 |

| September 2025 | October 10 |

| October 2025 | November 13 |

| November 2025 | December 11 |

(Check the official BLS site for the most up-to-date calendar.)

Reading Between the Lines

Mainstream outlets rarely say “whisper number.” But if you dig into market commentary ahead of releases, you’ll see the hints: “market nervousness,” “underlying expectations,” “positioning ahead of the data.” These coded phrases often reflect the undercurrent of whispers shaping sentiment.

Bottom Line

CPI whisper numbers are the shadow market before the market. They offer a glimpse of how smart money is positioning, but they come with danger attached. The winners aren’t those who simply hear the whisper—it’s those who can:

- Put it in context,

- Manage risk tightly,

- And act with discipline when the official number hits.

In trading whispers, edge comes not from hearing what others hear—but from knowing what to do with