TL;DR

American Eagle’s “Sydney Sweeney Has Great Jeans” campaign drove record engagement, sold-out items, ~700k new customers, and a 30–38% one-day stock pop. At the same time, a swift social backlash cooled runaway “sales go brrr” rumors and likely helped prevent a full meme-stock spiral. Net-net: the attention was accretive, and the controversy acted as a pressure valve—tempering overheated narratives while the brand converted a chunk of that attention to customers and denim sell-through. Reuters AP NewsPeople.com

American Eagle Outfitters Inc. (AEO)

1) What happened (and when)

- July 23, 2025 — AE launches the Sydney Sweeney fall denim campaign. Items she wore (“Sydney Jacket,” “Sydney Jean”) sell out in 1 day and 1 week respectively; AE reports “record-breaking sales” with double-digit denim increases shortly after launch. People.com

- Aug 1 — Brand posts a statement: the campaign “is and always was about the jeans,” doubling down amid criticism that the “jeans/genes” pun carried eugenics undertones. E! OnlineInstagram

- Aug 3–12 — Foot traffic data (Pass_by) show near-term declines (≈-9% YoY for the week of Aug 3; ≈-1.3% YoY for August overall). The attention was real, but store visits dipped before rebounding later. Forbes Retail Brew

- Sept 4 — On/after Q2 results, AE says the campaign (plus Travis Kelce tie-in) delivered >700k new customers and ~40B impressions; shares jump ~33–38% intraday. Q2 revenue: -1% YoY to $1.28B (campaign launched late in the quarter). Reuters AP News Investopedia

Key takeaway: Attention converted to measurable outcomes (customers, sell-outs), even while near-term store traffic wobbled.

2) Rumors vs. reality: Did it really blow the doors off?

- Rumor cycle: Social chatter portrayed a moon-shot sales impact (“everything sold out,” “sales records everywhere”). Some of that proved true for featured items and denim broadly. People.com

- Reported data: Management highlighted unprecedented new customer acquisition and massive reach; the stock ripped 30–38% on the update day. But Q2 sales were still slightly down YoY because the campaign was late-quarter. Short interest sat around ~16.6% of float, amplifying the move. Reuters

- On the ground: Pass_by foot-traffic reads suggest the initial controversy window coincided with softer in-store visits, before momentum built into Labor Day and back-to-school. Forbes Retail Brew

Interpretation: The campaign drove real commercial lift but not the unlimited rocketship some rumors implied. The signal: customer adds and denim velocity, not a quarter-over-quarter revenue explosion.

3) Why the backlash actually helped (from a market-micro view)

- Narrative moderation: The backlash hijacked part of the discourse from “parabolic sales” to “is the pun tone-deaf?”, which dampened over-bullish rumor velocity just as meme-trader interest stirred. That helps reduce the risk of a hype bubble that management then cannot meet with near-term fundamentals. Investopedia

- Expectation management: AE reiterated the campaign’s intent and kept Sweeney front-and-center for 2H—absorbing controversy while protecting forward expectations (flat FY comps guidance raised to “flat,” with upside framed in 2H). Reuters

- Proof in the print: Shares still spiked 30–38% on the update day, but the company also communicated that Q2 revenue was -1% YoY—a realistic base from which to compound rather than a rumor-inflated bar that invites a whipsaw. AP NewsInvestopedia

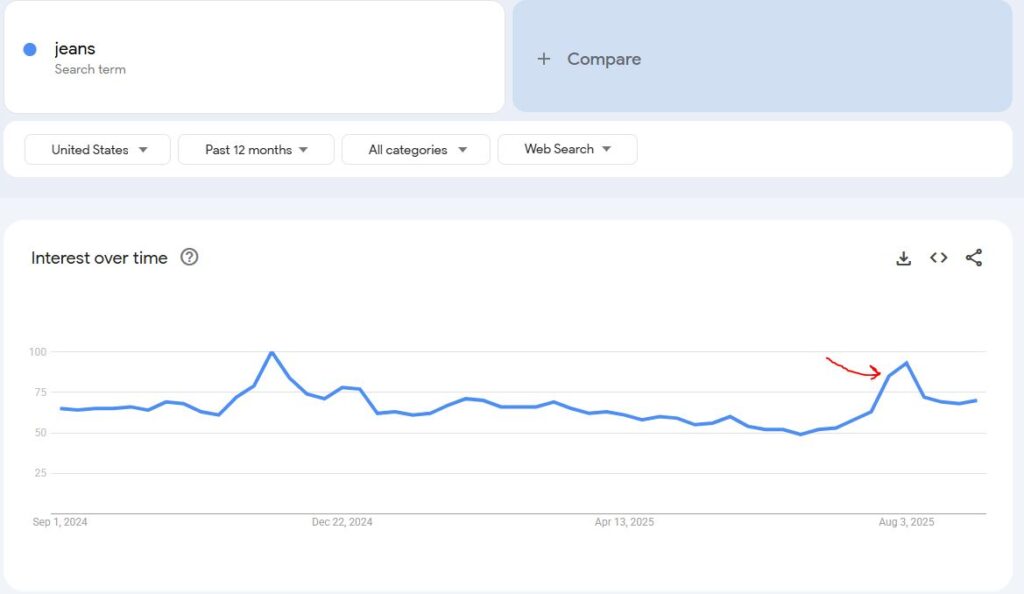

4) Google Trends: “Jeans” spiked to Black-Friday-like levels in August

Back-to-school is denim season, and search interest for “jeans” surged in August to near-peak levels typically seen around Black Friday/Cyber Week. Third-party analyses tracking Google Trends show August 2025 U.S. interest reaching the 80s–100 (peak) range for variants like “women’s jeans” and “black ripped jeans,” indicating a seasonal crest on par with holiday spikes. Accio

Replicate it: In Google Trends, set Region = United States, Time = Sep 2024–Sep 2025, Term = jeans. You’ll see late-Aug interest approaching yearly highs comparable to late-Nov peaks.

(Context on holiday search seasonality: Black Friday queries cluster in Oct–Nov; “jeans” shows a second seasonal crest for back-to-school.) Google Trends

5) What to steal (playbook)

- Celebrity + Product Truth: The message (“Great jeans”) and the product (denim fits) were tightly aligned. That’s why the brand could confidently double down amid pushback. E! Online

- Speed to Clarify: Addressing the pun early with a simple, ownable statement contained reputational drift and kept the story about jeans. Instagram

- Measure the funnel, not the noise: Track customer adds, sell-through, and returns. Short-cycle foot traffic can wobble even as e-comm and brand discovery surge. Forbes Retail Brew

- Expectation hygiene: Let viral attention feed a better 2H setup rather than promising instant step-function revenue. The market rewarded credible momentum, not exaggerated claims. Reuters AP News

6) Metrics snapshot

- New customers: >700k since Sweeney/Kelce launches.

- Impressions: ~40B across channels.

- Stock reaction: +30–38% on Sept 4.

- Q2 revenue: $1.28B (-1% YoY); campaign began late in quarter.

- Select items: Sold out within days; double-digit denim growth post-launch.

- Foot traffic: -9% YoY week of Aug 3; -1.3% YoY for August.

7) Bottom line

AE generated a rare combo: culture-scale reach and commercial signal—without letting rumor-fueled exuberance outrun reality. The backlash, counter-intuitively, kept expectations tradable, while the brand harvested attention into denim demand and a wider customer file. For marketers, that’s the blueprint: aim for big swings, clarify fast, measure real, and let the internet argue while you sell jeans.

Sources & further reading

- Reuters: AE “rides high,” +33% on the day; 700k new customers, 40B impressions; campaign to continue. Reuters

- AP: Shares +34% as AE says frenzy drew new customers; Q2 revenue context. AP News

- People: Record-breaking denim sales; specific sell-outs and double-digit growth; brand doubled down publicly. People.com

- Investopedia: Stock turnaround, Labor Day strength, analyst color on sustainability. Investopedia

- Pass_by via Forbes/Retail Brew: Foot traffic down 9% (wk of Aug 3) and -1.3% in Aug. Forbes Retail Brew

- Google Trends benchmarking for “jeans” seasonal peaks (holiday vs. back-to-school). Google Trends